Where to Find Reliable hard money lenders in Atlanta Georgia

Where to Find Reliable hard money lenders in Atlanta Georgia

Blog Article

Why a Hard Money Finance May Be the Right Option for Your Next Investment

In the realm of realty financial investment, the quick pace and high risks frequently require unusual financing services. Enter difficult cash financings, a tool that focuses on swift approval and financing, as well as the home's value over a borrower's credit rating history. In spite of their potential high costs, these finances can be the key to unlocking your next financially rewarding offer. However what makes them a feasible option, and when should they be taken into consideration? Let's unfold the story.

Recognizing the Essentials of Tough Cash Car Loans

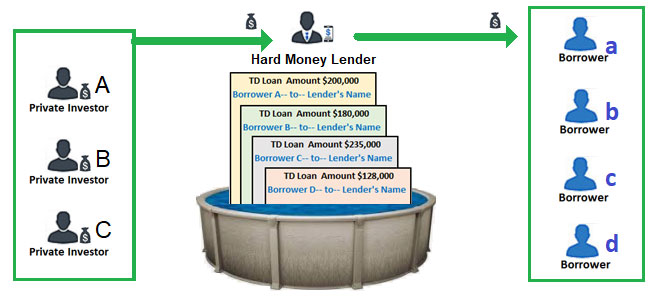

While typical financings may be acquainted to most, comprehending the basics of difficult money loans is critical for prospective capitalists. Tough cash lendings are a kind of short-term financing where the financier safeguards the Loan with genuine estate home as collateral. Lenders are usually personal business or people, making the Financing terms and prices more versatile than standard financial institution fundings.

The Advantages of Picking Tough Cash Financings

Prospective Disadvantages of Hard Money Loans

In spite of the advantages, there are additionally potential downsides to consider when handling difficult cash fundings. The most significant is the high rate of interest. Since hard cash lenders handle even more danger with these fundings, they often need higher returns. This can indicate passion rates that are much greater than those of standard car loans (hard money lenders in atlanta georgia). One more drawback is the short Lending term. Tough money car loans are normally short-term finances, usually around 12 months. This can put stress on the debtor to settle the Funding swiftly. These finances also have high fees and closing costs. Borrowers might have to pay numerous factors in advance, which can include significantly to the overall price of the Finance. These variables can make hard cash loans much less eye-catching for some capitalists.

Real-Life Scenarios: When Tough Cash Financings Make Feeling

Where might hard money useful link financings be the optimal monetary option? They often make good sense in scenarios where people or firms need quick access to resources. Genuine estate capitalists looking to take a time-sensitive opportunity might not have the high-end to wait for typical bank finances. Difficult money loan providers, with their faster approval and disbursement procedures, can be the secret to protecting the property.

An additional circumstance is when a capitalist intends to remodel a property prior to selling it. Right here, the difficult cash Loan can finance the remodelling, boosting the residential property's value. The Loan is then settled when the home is offered. Hence, in real-life scenarios where speed and adaptability are essential, difficult money finances can be the optimal service.

Tips for Browsing Your First Hard Money Financing

Just how does one why not check here efficiently navigate their first hard money Financing? The procedure might seem daunting, but with cautious planning and understanding, it can come to be an important device for investment. Study is critical. Know the specifics of the Financing, consisting of rates of interest, payment terms, and feasible penalties. Second of all, recognize a reputable lender. Search for transparency, expertise, and a strong track record. Finally, guarantee the financial investment property has possible revenue enough to cover the Funding and create revenue. Have a leave technique. Hard money car loans are short-term, normally 12 months. Recognizing exactly how to pay it off-- whether with offering the residential property or other refinancing options-- minimizes danger and makes best use of gains.

Verdict

To conclude, difficult money lendings supply a quick, versatile financing alternative genuine estate capitalists aiming to take advantage of time-sensitive possibilities. Regardless of potential downsides like greater rates of interest, their simplicity of accessibility and concentrate on home value over credit reliability make them an attractive option. With mindful consideration and audio investment approaches, hard money loans can be an effective tool for maximizing returns on short-term projects.

While traditional loans might be acquainted to most, understanding the basics of hard cash financings is vital for prospective capitalists. Tough money fundings are a kind of temporary funding where the financier safeguards the Finance with actual estate home as security. Lenders her comment is here are usually exclusive companies or people, making the Lending terms and prices more versatile than traditional bank loans. Unlike conventional financial institution loans, tough cash lenders are primarily worried with the value of the building and its possible return on investment, making the authorization process much less rigid. Difficult money financings are commonly temporary loans, typically around 12 months.

Report this page